|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Refinance House While in Chapter 13: Key Considerations and StrategiesRefinancing your house during a Chapter 13 bankruptcy can be a daunting process, but it is not impossible. By understanding the requirements and preparing adequately, you can improve your financial situation significantly. This article explores the essential aspects and strategies involved. Understanding Chapter 13 BankruptcyChapter 13 bankruptcy allows individuals to reorganize their debts and create a repayment plan over three to five years. Unlike Chapter 7, it does not involve liquidating your assets, which means you can keep your home while paying off your debts. Eligibility for RefinancingRefinancing during Chapter 13 requires court approval. Lenders may also have specific requirements, such as:

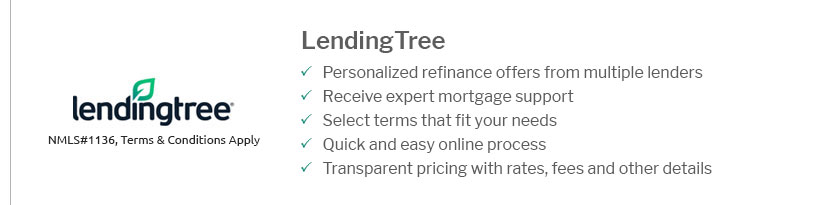

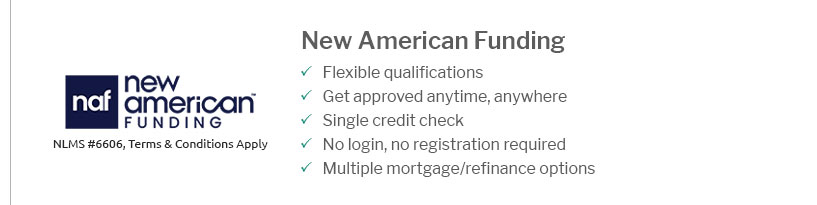

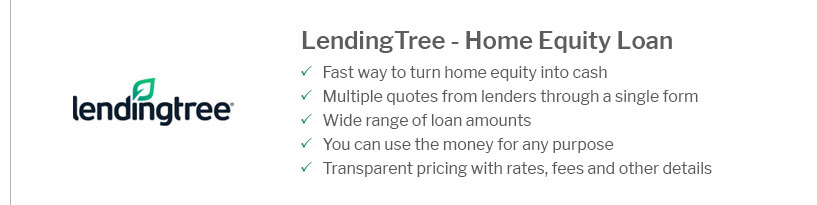

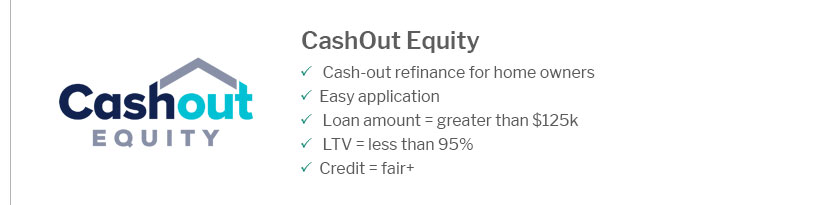

Steps to Refinance During Chapter 131. Court ApprovalThe first step in refinancing is obtaining permission from the bankruptcy court. This involves submitting a motion to refinance, detailing how it benefits your financial plan. 2. Finding a LenderWhile challenging, finding a lender willing to work with you during Chapter 13 is possible. Consider comparing options like home refinance rates 15 year fixed to find competitive terms that suit your situation. 3. Submission of DocumentsPrepare to provide extensive documentation, including income statements, tax returns, and details of your bankruptcy plan. Benefits of Refinancing During Chapter 13Refinancing can offer several advantages, such as:

Challenges and ConsiderationsDespite the benefits, there are challenges and considerations:

Frequently Asked QuestionsCan you refinance a house while in Chapter 13?Yes, you can refinance during Chapter 13, but you need court approval and must meet specific lender requirements. How does refinancing affect Chapter 13 repayment plans?Refinancing can potentially lower your monthly obligations, making it easier to meet your Chapter 13 repayment terms. Are there specific lenders for Chapter 13 refinancing?Some lenders specialize in working with individuals in bankruptcy, so exploring options like home refinance rates 30 year fixed can be beneficial. In conclusion, refinancing a house while in Chapter 13 requires careful planning and coordination with legal and financial professionals. By understanding the process and requirements, you can achieve a more stable financial future. https://ficoforums.myfico.com/t5/Bankruptcy/Can-you-refinance-mortgage-in-chapter-13/td-p/6194496

Unless you are paying back 100%, you won't be able to pocket the mortgage savings until you are done with the 13. The trustee will simply ... https://www.peoplesbankmtg.com/buying-home-in-chapter-13-bankruptcy/

Yes, you can! You can get a mortgage while you are still making payments on your Chapter 13 plan. Government-backed loans like FHA, VA, and USDA mortgages are ... https://www.youtube.com/watch?v=Z8FX5gVwmmo

If you are in a chapter 13 bankruptcy repayment plan you may be able to use your homes equity to get out of your bankruptcy early.

|

|---|